THIS POST MAY CONTAIN AFFILIATE LINKS, MEANING I RECEIVE A COMMISSION FOR PURCHASES MADE THROUGH THESE LINKS, AT NO COST TO YOU.

The world revolves around money. You need money to get things done in any part of the world. Your money and your assets determine your net worth, and your net worth in turn determines your financial situation.

You can take control of your financial situation and your financial life using a simple smartphone app – Truebill.

Taking control of your financial life involves tracking and managing finances, identifying and monitoring subscriptions, planning and following through a budget, tracking bills, and more.

As you can see, there are a lot of factors involved in getting your financial life together. You have to take care of all of those factors individually, simultaneously and repeatedly to take control of your financial life.

Staying on top of finances is not everyone’s cup of tea. Not everyone knows how to control their finances. It can even get hectic and stressful for some people.

Fortunately, in this day and age, managing finances is not complicated anymore. People can now take control of their financial life very easily by using Truebill.

What Is Truebill?

Truebill is a simple and a sleek smartphone app that puts you in control of your finances. An average Truebill user saves over $700 per year.

Truebill is an all-in-one finance app. After you use Truebill, you would not want to use any other finance app. This is because while other finance apps mostly offer only individual features, Truebill offers many different essential features in one single app.

With Truebill, you can manage your bills and subscriptions, track your spending, lower your bills, create a budget, automate your savings, and do much more.

Why Truebill?

There is are several reasons why people absolutely love Truebill. Here are some of the reasons why you would love Truebill too:

- Truebill gives you a complete snapshot of your financial situation instantly from within the app.

- Most of the essential features are free, but you can upgrade to Truebill Premium for more useful features.

- You can link all of your bank accounts with Truebill to have all of your transactions in one place.

- Truebill offers bank-level security and does not store any of your banking credentials.

- You can get your phone, internet, cable and other bills lowered with Truebill.

- You can ask Truebill to request refunds from your banks for any fee your they may have charged you.

- Truebill lets you automate your savings, so you do not have to worry about transferring your funds into a savings account manually.

- Truebill populates all the services you are subscribed to for you to see exactly what services you are paying for on a recurring basis.

- With Truebill, you can cancel your subscriptions from within the app.

- You get access to spending reports that let you track your expenses in detail.

- You can conveniently set up budgets from within the app to keep your financial life organized.

How Safe Is Truebill Really?

Truebill is very safe. You can confidently manage your finances in your Truebill app. Truebill offers bank-level security and uses state-of-the-art security features to protect your finances and your financial data. Your data is stored securely with 256 bit encryption.

Truebill uses Plaid to connect with bank accounts. Plaid is a highly secure and a trusted platform that lets smartphone applications such as Truebill connect with bank accounts securely.

Truebill never stores your online banking credentials. They also cannot move or withdraw money from your Truebill account.

Check out Truebill’s security page to read more about their security practices.

The Awesome Features Of Truebill

Truebill is truly a unique app. The features packed within the app are everything you need to take control of your financial life.

1. View A Complete Summary Of Your Finances

You may have several bank accounts. Viewing each account separately is not only hectic but also time-consuming. Furthermore, viewing different bank accounts separately may lead to under-estimation or over-estimation of your actual financial health.

Having a complete summary of your finances from all your bank accounts in the dashboard of the Truebill app makes it very easy to understand how your finances are doing.

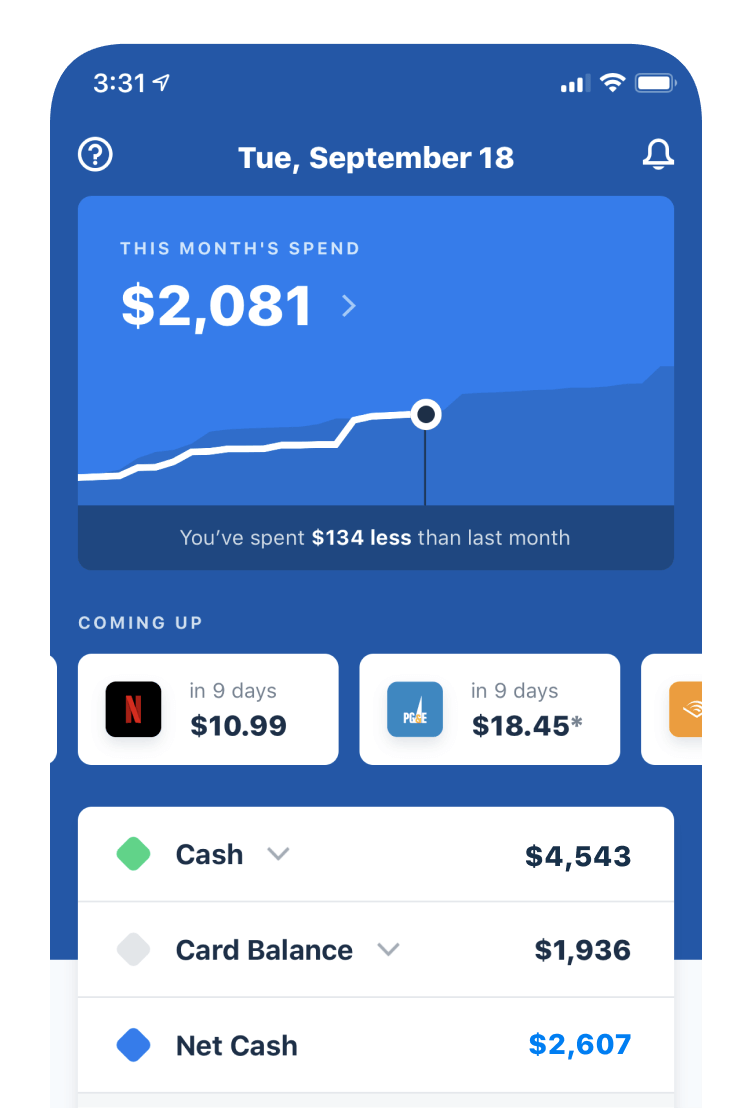

You can see a summarized view in the dashboard of your app that includes your cash balance, your card balance, upcoming subscription charges, and a graph comparing your current month’s spending to the previous month’s spending.

2. Identify And Cancel Unwanted Subscriptions

Very often, people subscribe to services and forget about them. These subscription charges may seem negligible at first, but can add up over time.

You could also be paying way more than what you are actually using. Perhaps, the number of features you actually use fall under a cheaper subscription plan you are not aware of.

Truebill does an excellent job in listing out all the services you are subscribed to. You can also see the amount that you will be charged as well as the date on which you will be charged that amount. You can view this information in the “Calendar” view or in the “List” view.

By having all of the subscription charges in one place, you can easily monitor the services you are paying for. You can then make decisions to keep, downgrade or cancel those services.

If you wish to cancel any of your subscriptions, you cancel them from within the app.

3. Analyze Expense Reports

Expense reports help you understand how well you are doing financially. They give you a complete picture of your spending habits.

Having the expense reports feature in Truebill is extremely beneficial. These reports tell you exactly how much money you spent each month in the last 12 months. You can also see how much more or less money you spent each month compared to the previous month.

The information is presented in the form of a bar graph. You can click on each month’s data to view more details about how much money you earned and how much money you spent in that month.

4. Get Your Bills Lowered

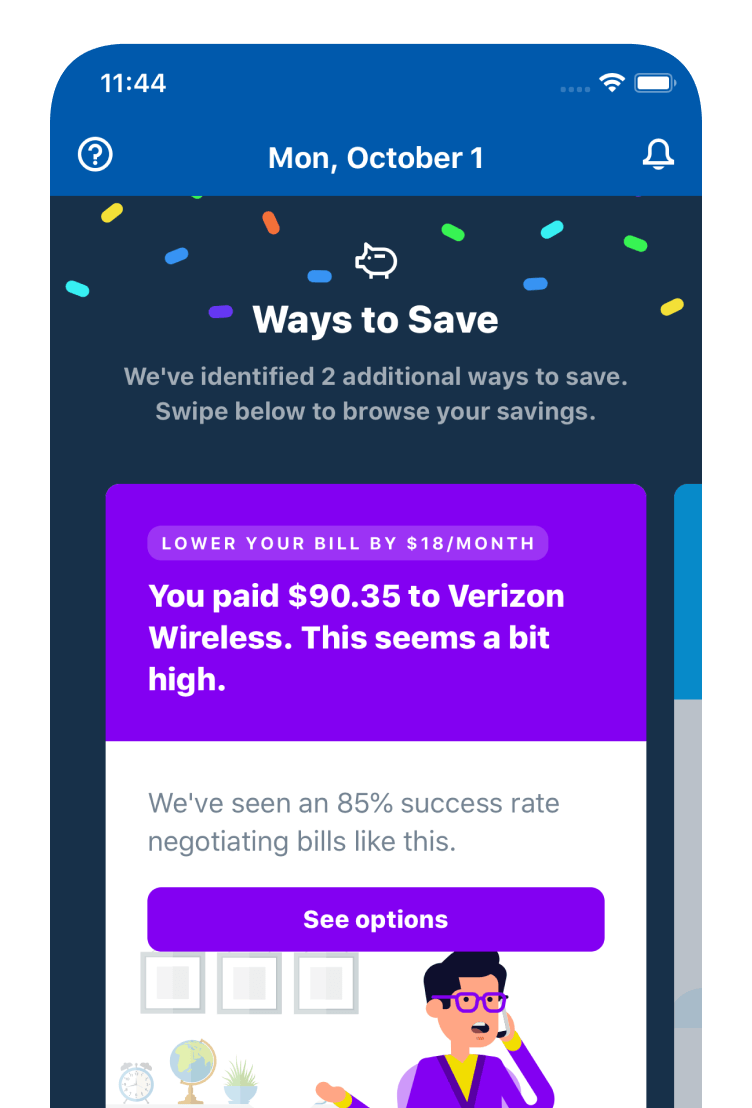

You might be overpaying your bills. Did you know that you can get your bills lowered by negotiating with your service providers? You can negotiate with your service provider yourself or you can use Truebill’s bill negotiation services.

You can request Truebill to negotiate and lower your phone, wireless, home security, internet and cable bills. They have a success rate of 85% when it comes to negotiating with service providers.

Truebill does charge you a fee. They charge you 40% of the first year savings ONLY if they are successful in lowering your bill. They do not charge you a fee if they are not successful in negotiating with your service provider.

5. Set Up Budgets

Having a budget is extremely important as it prevents you from going overboard with expenses. With Truebill, you can set up your own monthly budgets.

You can set limits for each category that you usually spend your money on. These categories are called spending goals. For example, you can create a grocery spending goal and set it at $300. This would mean that you should spend a maximum of $300 on groceries every month.

Once you have set your goals, you can see how much more money you can spend or how much money you have overspent in every category for the rest of the month.

The Amazing Features Of Truebill Premium

Truebill Premium offers even more features that can help you save money and let you make smarter decisions about your money. You can subscribe to Truebill Premium for as low as $3/month.

1. Automate Your Savings

It is very important to set aside some amount every month as savings if you want to grow financially. If you are not saving any money yet, its not too late to get started!

With Truebill Premium, you can easily automate your savings and forget about transferring funds manually. You can create a savings goal, schedule automatic transfers, and withdraw at any time.

Your funds are FDIC insured. Your Truebill savings account is held in an FDIC insured US based bank account. So you can confidently deposit money into your Truebill savings account knowing that your funds are safe.

2. Create Unlimited Budget Categories

While you can set up monthly budgets in the free version of the Truebill app, you can only create a maximum of 2 budget categories (or spending goals) in the free version of the app.

In order to take full advantage of Truebill’s budgeting functionality, you have to upgrade to Truebill Premium. With Truebill Premium, you can create unlimited budget categories.

With the unlimited budget categories functionality, you can organize your finances and set your spending goal limits exactly the way you want.

3. Get Bank Fee Refunds

You may incur bank fees in the form of overdraft or late fees. You can get refunds for bank fees with Truebill Premium.

Truebill automatically detects and notifies you when you are charged bank fees. You can then request a refund from your bank from within the app.

The Truebill team then does its best to get those refunds for you. However, keep in mind that banks do not approve of all fee refund requests.

4. Cancel Subscriptions Automatically

Truebill lets you see exactly all the services you are subscribed to. You may be paying for services that you no longer use. You can cancel these unwanted services inside the Truebill app.

However, you do not have to cancel the subscriptions yourself. With Truebill Premium, you can have a Truebill concierge cancel them for you.

So to have a peace of mind, use Truebill Premium’s automated subscription cancellation feature.

5. Sync Accounts In Real Time

After you link your bank accounts to Truebill, your balances are automatically updated every 24 hours.

However, if there’s a recent transaction that you would like to see in your Truebill app or if you do not like delays in viewing transactions, you would have to upgrade to Truebill Premium to use the “Sync” functionality.

The Sync function allows you to update your account balances in real time. So quit waiting and let Truebill fetch the latest account data for you.

How You Can Sign Up

Signing up is very easy. All you have to do is click here and download the Truebill app.

Once you are in the app, sign up and link your bank accounts.

Next, take full control of your financial life!

If you liked this post, pin it!

I’ve never heard of truebill before but by the sounds of all the features I probably should start!

Truebill indeed has a lot of features! You can truly take control of your financial life using this all-in-one app. Once you start using this app, you would be reluctant to use any other financial app.